Carbon taxes could cost companies 10% of their turnover by 2030

- Author

- Marie-Anne VincentVP Strategy & Regulatory

- Category

- Insight

- Topics

- Regulations

- Published

- 18 January 2023

The EU has agreed to implement a carbon tax on high-carbon products. Here's how it could impact your business and how you can anticipate them.

The main goal of carbon pricing in the form of a tax or quota trading system (ETS), is to encourage companies to lower their emissions. Emissions are effectively an additional production cost, so there's a direct incentive for businesses to reduce them. This could also offer a source of revenue to governments, which they can invest in the low-carbon transition.

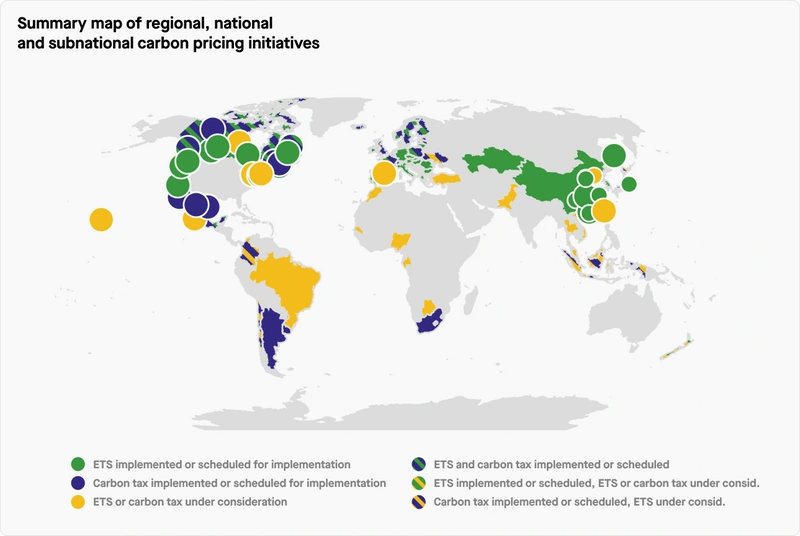

More and more countries are putting in place regulatory carbon pricing mechanisms, based on the ‘polluter pays’ principle. Carbon pricing is one of the main tools to accelerate the decarbonization of economic activities.

The Border Carbon Adjustment Mechanism (CBAM)

Last month, EU negotiators reached an agreement on the implementation of a border carbon adjustment mechanism (CBAM) taxing imports of high-carbon products from countries that don’t properly price greenhouse gas emissions.

As the Word Bank map shows, the scope of carbon pricing instruments will increase further in the coming years:

Source: The Word Bank

What are carbon price projections?

Carbon prices have broken a new record in Europe reaching €97/tCO2eq in February 2022, a 200% growth compared to February 2021. These developments are already having an impact on businesses, and the consequences are going to be increasingly severe.

"The economic weight of the carbon price for the most fossil fuel dependent sectors could reach more than 10% of their turnover in 2030, according to their scenario built to approach a 1.5°C world," according to this EcoAct's study.

This projection is based on the assumptions of the IPCC which targets a carbon price around US$220 per tCO2eq in 2030 and US$630 per tCO2eq in 2050 in order to get companies to follow a 1.5°C trajectory.

Why is it important to take action now?

Companies must therefore anticipate and act – starting with integrating an internal carbon price to drive their business, as Renaud Bettin, Sweep's VP of Climate Action, points out in the Carbon Pricing Leadership Coalition’s blog:

“Companies need to move past the sheer number of CO2 removed and see their financial contributions to carbon neutrality as a key indicator of their climate performance. By creating a budget based on an internal carbon price, they can invest in decarbonizing their products or services and support impactful climate projects."

Learn more

🔎 Why we need to simplify carbon pricing mechanisms

✒️ How to set an internal carbon price in your company

🙌 Discover projects that are making a positive impact

More stories

Track, report and act

Sweep helps you get your carbon on-track

Sign up to The Cleanup, our monthly climate newsletter

© Sweep 2024