Sweep for Finance

Your financed emissions on-track

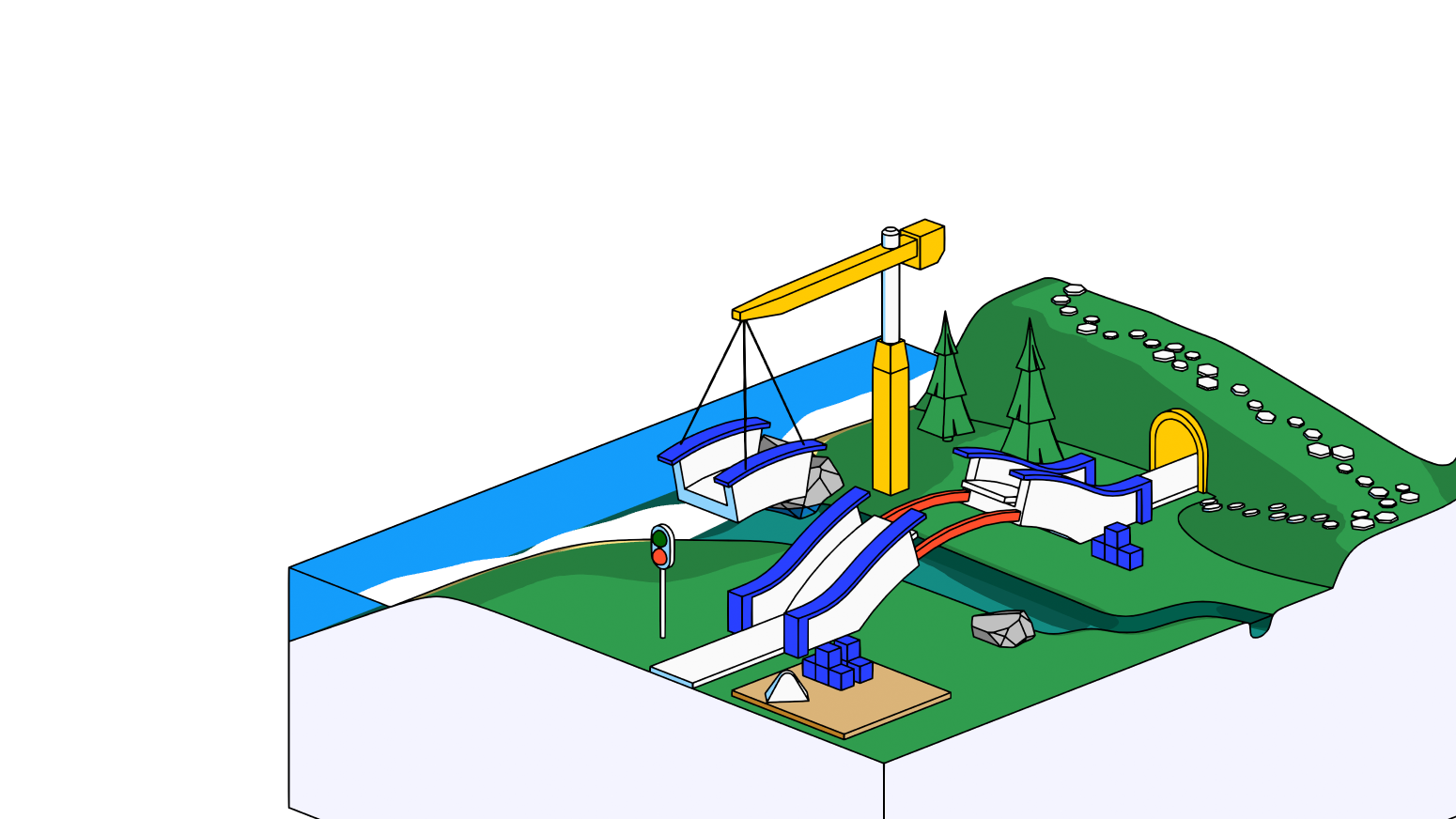

Meet Sweep for Finance

Get accurate carbon data on your investments. Whether you’re an asset manager, investment bank, or private market investor.

"Sweep measures any company's scope 1, 2 and 3 and creates reduction trajectories. It's the solution everybody's been missing to compute and disclose financed emissions."

Lorraine Artur de La Villarmois

Head of Legal & ESG

"With Sweep's CDP-based assessments and surveys, we can get an accurate carbon footprint of our firm operations and estimate our financed emissions with both our private and public investments"

Ryan Williams

CSO

"This is the most promising tool to obtain a 360 view of all investments, from listed to real assets, and help sustainability-driven asset managers track their global climate strategy"

Philippe Zaouati

CEO

Get accurate carbon data on your investments. Whether you’re an asset manager, investment bank, or private market investor.

Model hotspots

Map your portfolio and focus on your strategic partners. 20% of them are likely responsible for 80% of your scope 3 emissions.

Request granular data

Automate data collection from your investments, and send surveys that can help fill in any data gaps.

Share targets

Drive collective and collaborative climate action along your portfolio by setting shared climate targets and monitoring progress.

Backed by carbon expertise

Sweep is built to comply with leading international accounting standards.

Aligned with industry disclosures

Built for emission data you can trust

💯 Completeness

Help your suppliers measure all their required emissions.

🔐 Data security

We’re SOC2 compliant and ISO 27001 certified. Learn more about security

🔍 Transparency

Keep a clear audit trail, with documents and descriptions for your data stored right in Sweep.

🧭 Accuracy

See where all your supply chain data comes from. And improve it with a scoring system.

🎛️ Consistency

Use consistent methodologies, like the GHG Protocol, for meaningful emission tracking over time.

Our customers are making a difference

Here’s how we’re building a cleaner future together.

Materials

Explore our materials to learn more about acting on your portfolio emissions

As a financial institution, you indirectly contribute to greenhouse gas emissions through your financing or investment activities. These emissions can occur throughout the value chain of the companies and projects you finance, including production, transport, and use of goods and services.

They usually form the largest part of most financial organizations’ carbon footprints. That’s why it’s so important to disclose these as part of your efforts to manage climate-related risks and opportunities.

To help financial organizations align their investments with the Paris Climate Agreement, the Science-based Targets Initiative (SBTi) developed the concept of a finance portfolio temperature.

This is a metric that calculates the average temperature increase that would result from the greenhouse gas emissions associated with an investment portfolio. The finance portfolio temperature allows investors to evaluate the climate impact of their investments and to set targets to reduce emissions and lower the temperature increase associated with their portfolios over time.

Firstly, there is a growing demand from stakeholders, particularly institutional investors, for more transparency and disclosure on environmental, social, and governance (ESG) factors, including climate change.

Secondly, there is a growing regulatory pressure on financial institutions to disclose their climate-related risks and opportunities. Several countries have introduced regulations that require financial institutions to disclose their climate-related risks and to report on their progress towards meeting climate targets.

You’re also likely to discover that measuring and managing your financed emissions can help you identify opportunities to improve the sustainability and resilience of your portfolio companies.

Ready to get your financed emissions on-track?

Get in touchTrack, report and act

Sweep helps you get your carbon on-track

Sign up to The Cleanup, our monthly climate newsletter

© Sweep 2024