What is the true ROI of Decarbonization?

- Category

- Insight

- Topics

- CarbonESG

- Published

- 29 May 2024

Contents

- Better access to capital

- Competitive advantage

- Compliance and risk mitigation

- Talent attraction and retention

- Measuring the ROI of decarbonization in 5 steps

- 1. Measure emissions

- 2. Set a decarbonization strategy

- 3. Calculate initial investment and model trajectories

- 4. Calculate ongoing savings and potential new business

- 5. Evaluate ROI

- Ready to get started?

Over the past decade, businesses have faced increasing pressure to prioritize climate action due to shifts in regulation, scientific consensus, and cultural values. Governments and NGOs have made significant strides in combating climate change, but the private sector, responsible for the majority of global carbon emissions, must also play a critical role. Investor, consumer, and regulatory pressures are making robust climate programs essential for financial success.

Here’s why prioritizing sustainability is beneficial for business:

Better access to capital

Investors and corporate lenders are increasingly factoring corporate climate programs into their decisions, recognizing that climate risk equates to investment risk. For businesses in emission-intensive sectors or regions requiring climate disclosure, understanding and mitigating these risks is crucial. Today’s investors demand that companies not only recognize climate risks but also disclose them and have robust mitigation plans.

As a result, investors are channeling capital towards companies poised to thrive in a zero-carbon economy. For instance, 450 financial institutions have joined the Glasgow Financial Alliance for Net Zero (GFANZ), representing 40% of the world’s capital.

Companies investing in climate programs, often integral to broader ESG initiatives, see clear payoffs.

- According to research from PwC, 30% of investors claim they have difficulty locating suitable and appealing ESG investing possibilities, despite the market's explosive growth for ESG investment products.

- McKinsey reports that higher ESG scores can lower capital costs by roughly 10%.

- Research from Harvard Business School found that companies with robust sustainability practices achieve better stock performance than their peers.

Competitive advantage

Corporate climate programs offer a new way to stand out in competitive markets. Strong sustainability programs, driven by ambitious commitments and emission reduction targets, help companies differentiate themselves. With over a third of the global economy committed to science-based targets, entire supply chains will need to follow suit. To win future contracts, suppliers must demonstrate meaningful climate action, as these actions contribute to their partners' Scope 3 emissions.

Consumers are also increasingly prioritizing sustainability:

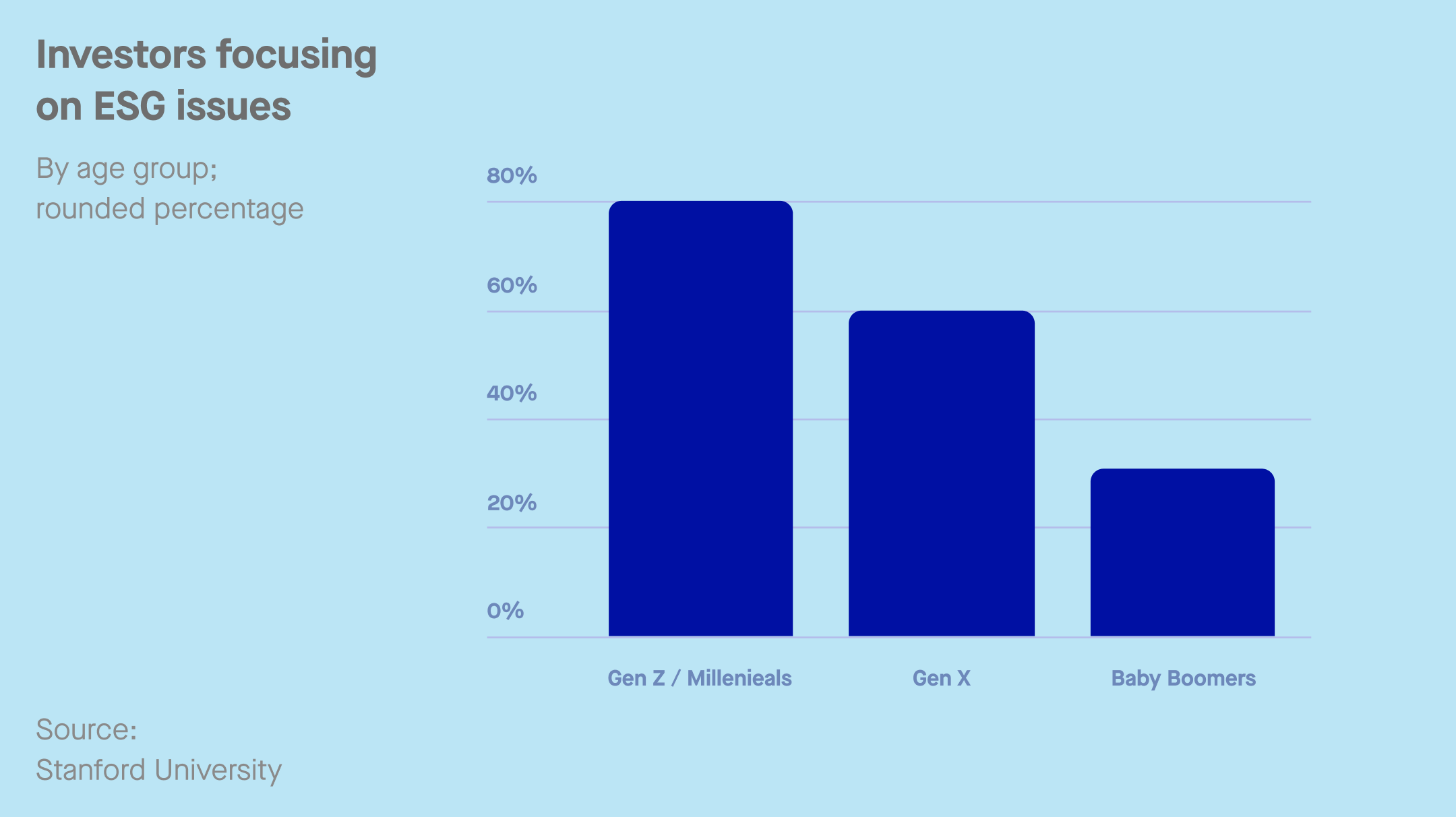

According to Forbes, a significant 88% of consumers show greater loyalty to businesses that support social or environmental causes, and Stanford University has completed a study on appetite for ESG issues among different age groups.

Compliance and risk mitigation

Non-compliance with major regulations such as the Corporate Sustainability Reporting Directive (CSRD) carries significant risks. For companies, including non-EU entities with EU subsidiaries meeting specific revenue thresholds, failing to disclose environmental, social, and governance (ESG) impacts can result in severe financial penalties. The CSRD mandates fines of up to 10 million Euros or 5% of annual revenue for non-compliance, underscoring the critical nature of transparent ESG reporting.

Beyond financial penalties, companies face substantial risks, including market exclusion, reputational damage, and supply chain disruptions. Non-compliant businesses may be barred from public contracts and lose market share, while reputational harm from failing to meet sustainability standards can deter consumers, investors, and potential talent. Additionally, non-compliance can lead to costly legal battles and remediation expenses. Overall, the costs of non-compliance with sustainability regulations can threaten a company's financial stability and long-term viability.

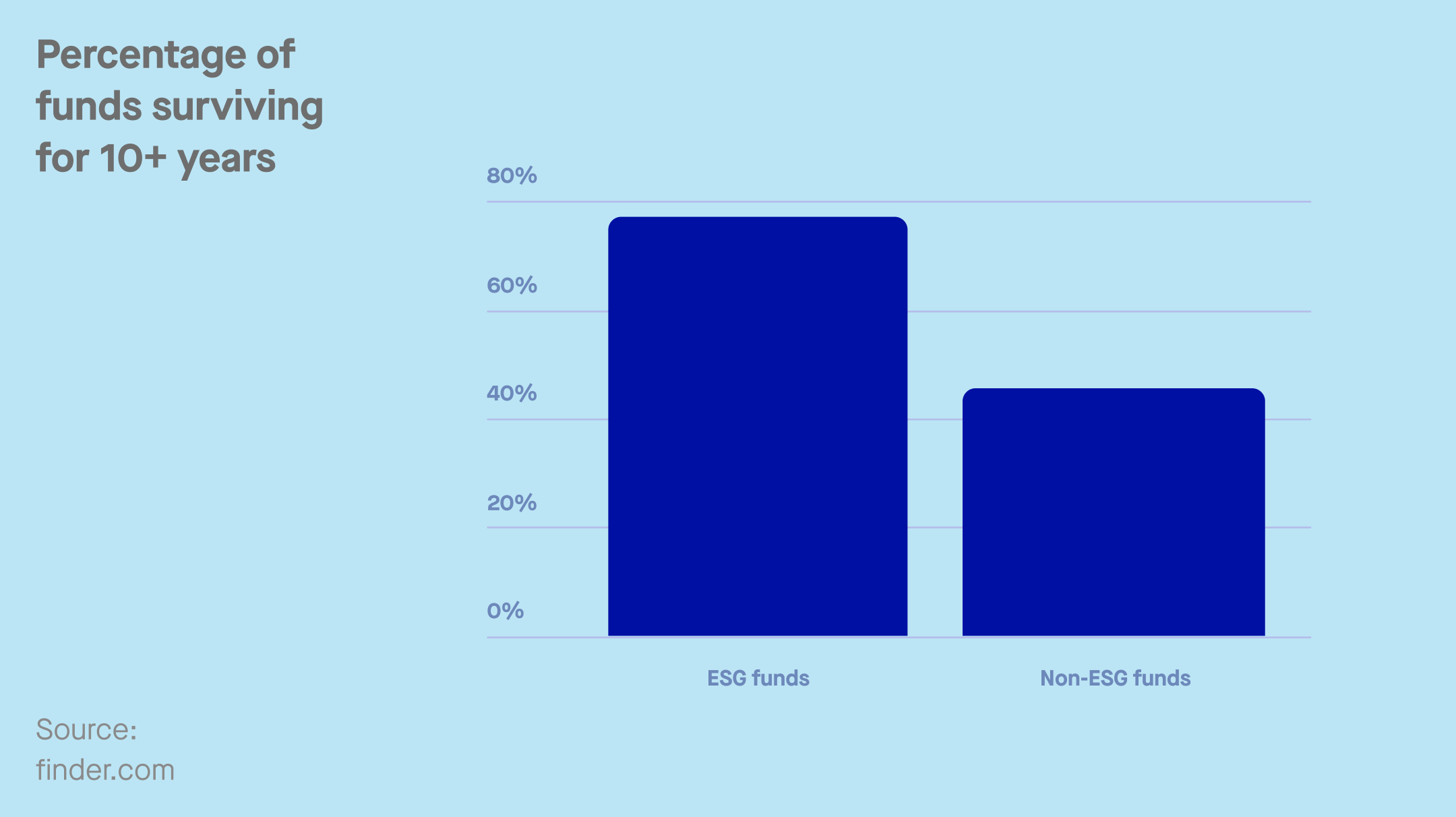

For small to medium businesses, the risk also lies in the likelihood of long-term survival, as demonstrated by research from Finder, below.

By 2026, sustainability metrics in investment plans are expected to be standard, with 60% of public companies incorporating them into ROI analysis. It's forecasted that 30% of total debt capital markets funding will go towards ESG initiatives.

Talent attraction and retention

Sustainability initiatives significantly impact employee attraction and retention. Younger generations, in particular, seek purpose in their work. Companies with strong ESG commitments are more attractive to this talent pool, leading to higher productivity and morale.

KPMG found that one-third of 18-24-year-olds have declined job offers from companies with weak ESG commitments – commonly referred to as ‘climate-quitting’.

Measuring the ROI of decarbonization in 5 steps

Despite the various factors influencing a company's decarbonization costs and ROI, five essential steps can help estimate these costs and determine the payback period for decarbonization measures.

1. Measure emissions

Start with a comprehensive carbon audit to measure emissions across operations, products, facilities, and suppliers. This initial and ongoing measurement will pinpoint emissions hotspots and guide the development of targeted strategies for effective decarbonization.

Effective carbon measurement starts with setting the boundaries of your inventory. You can find out more about it in our dedicated resource.

2. Set a decarbonization strategy

Once emissions hotspots are identified, explore potential decarbonization measures. Develop a strategic implementation plan prioritizing cost-effective options such as energy-efficient technology and the use of renewable energy. Work with suppliers from across your value chain on a joint decarbonization strategy.

Our decarbonization strategy guide can help.

3. Calculate initial investment and model trajectories

Determine the upfront costs for each decarbonization measure. These might include the purchase of equipment and its installation, staff training programs and more. Research available tax credits or subsidies and obtain quotes from suppliers or contractors to estimate accurate initial investment costs. Model the effectiveness of each method to optimize your time to value and return on investment.

4. Calculate ongoing savings and potential new business

Estimate the energy and operational savings from the decarbonization measures. Consider reduced energy consumption, lower utility bills, operational efficiencies, and potential regulatory compliance cost savings.

Also, factor in any potential new business or customers attracted by low-carbon products or services. You can do this by implementing customer surveys and feedback mechanisms, tracking referral sources, and using analytics tools to monitor customer acquisition channels. This will help you identify which customers were specifically drawn to your business because of your sustainability initiatives.

5. Evaluate ROI

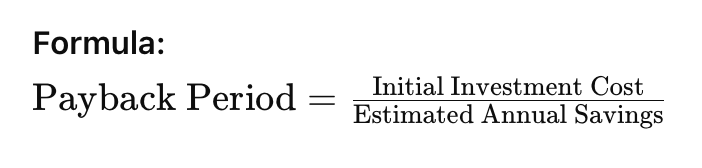

Calculate your payback period:

- Find the initial investment cost for each measure.

- Determine the estimated annual savings.

- Divide the initial investment cost by the estimated annual savings.

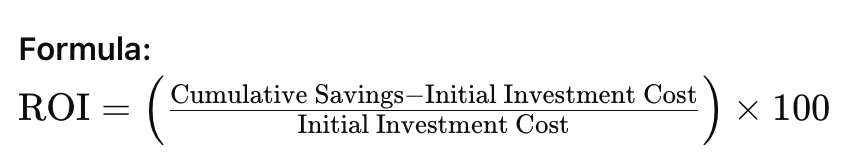

Calculate ROI:

- Find the initial investment cost.

- Calculate the cumulative savings over a specified period.

- Subtract the initial investment cost from the cumulative savings.

- Divide the result by the initial investment cost.

- Multiply by 100 to get the ROI as a percentage.

Compare the ROI of different measures to make informed decisions on future decarbonization investments.

By following the above steps, you can effectively measure the ROI of your decarbonization efforts, while at the same time modelling your growth trajectory and tracking the correlation.

How Sweep can help

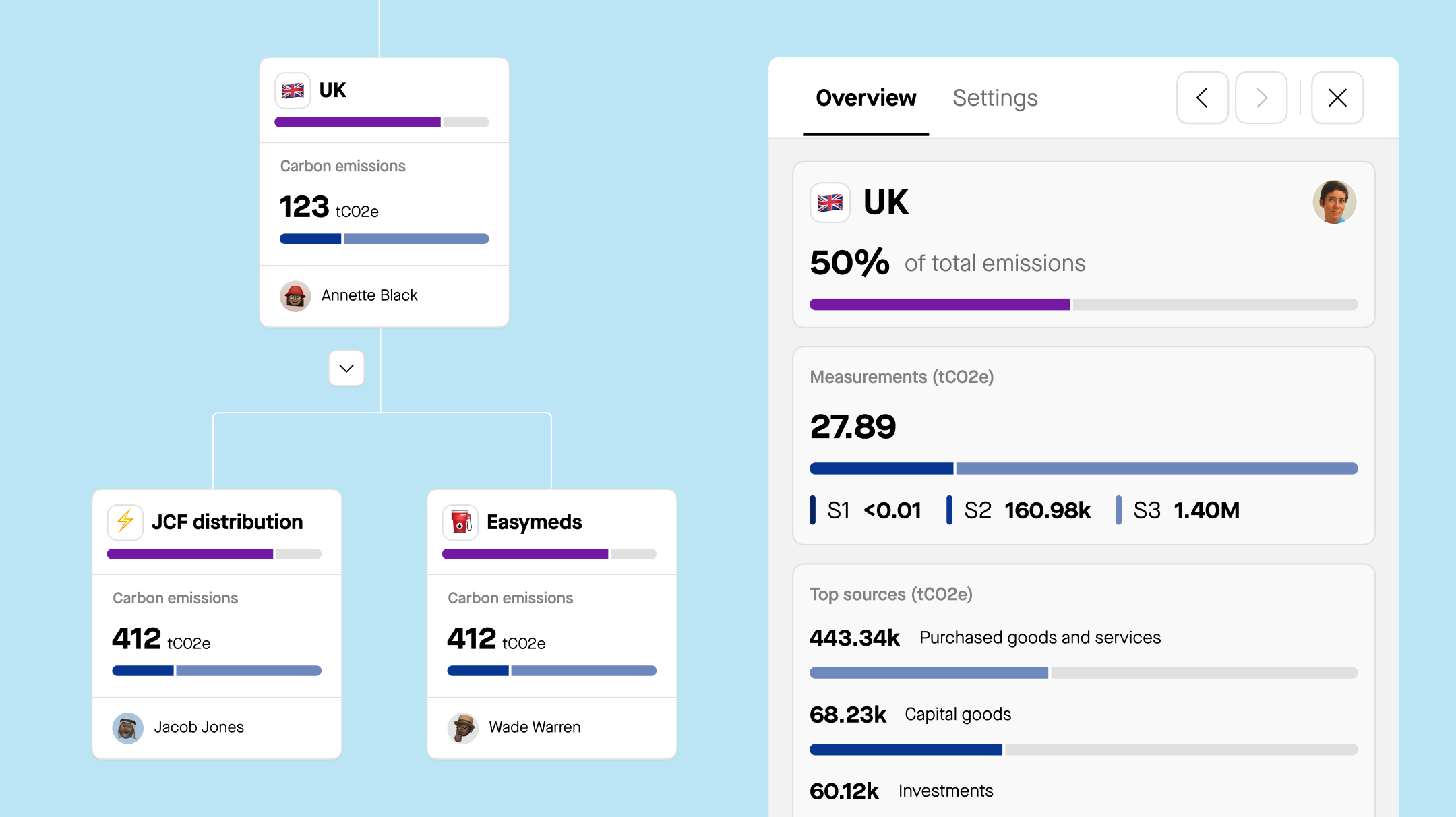

Sweep is built to make carbon tracking simple. You’ll start with a base understanding of your company’s emissions, using CDP data models to footprint your organization and value chain.With a clear map (which we refer to as a ‘Tree’ in Sweep) you’ll be able to visualize exactly what data you’ll need and from whom. You can also use this to conduct a baseline measurement of your emissions. In Sweep’s platform, all your measurement data is automatically tied to your targets. You can monitor how you’re doing in real time, and quickly adjust based on your incoming data.If you discover an initiative with great momentum, you can deploy it to other business units or geographies for a bigger impact.

Ready to get started?

We’re here to support you at every step. And your suppliers can get started for free!

Our free plan lets companies measure their emissions in Sweep – so you can invite all your suppliers.

Get in touch today.

More stories

Track, report and act

Sweep helps you get your carbon on-track

Sign up to The Cleanup, our monthly climate newsletter

© Sweep 2024